In the first of our monthly series, we’ll be taking a look at November's data, in review. The aim of this monthly instalment is to capture what’s going on in online retail, and how the market has been performing over the period. We’ll be taking a look at some data, in order to find out what key trends are occurring, and how this might affect the month ahead. So, what’s been going on in ecommerce in the month of November?

The event that’s been on everyone’s mind this month, (and year) is Black Friday. IMRG gathered some vital data on how the week performed, and the day itself. IMRG tracked 93 retailers, across November, to see how many sales went live, and what discounts were being offered. They found out that retailers did move their discounts and sales earlier, as expected, to move more stock, and mitigate the consequences of delivery problems and delays.

Then, looking at the market on the whole, Black Friday was down -14.3% overall, which was lower than was predicted (being around -10%). This is due to the high street reopening after a +30% growth rate YoY in 2020. 2021 just couldn’t match the same numbers. On top of this, average basket volume, and traffic, was down overall too (-15.8%). This suggests that there was a struggle to get people to visit individual websites. This can be considered an indicator of shoppers being drawn back to in-store shopping, after 2020, when they had no choice but to shop online.

(Source: IMRG)

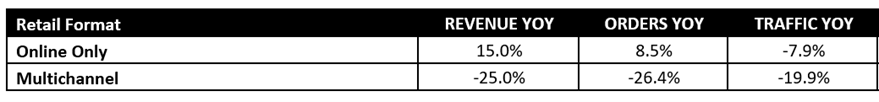

Interestingly, we saw that online-only retailers’ revenue are up +15% YoY, whereas omnichannel are down -25%. This could be because those with both online and in-person marketplaces saw more people returning to their stores, therefore decreasing those shopping online. It’s thought that returning to in-store shopping is seen as more of an event and an experience now, therefore people may be less inclined to shop around online, whilst in a store (as was common before the pandemic), so customers were just buying items when they found them in a store. This also eliminates the fear of delayed deliveries, as people can simply return home, with their item in hand.

Electricals was the category which took the biggest hit, down -37.5% revenue. Because of this, any retailer who reported greater than 10% YoY growth can consider themselves in the top fifth of performance this year.

Overall, the market has been down during November and Black Friday, however, it seems like those early sales were a driving factor in maintaining sales and avoiding worse losses.

About the author