Among all the 2026 delivery trends we have identified, one force keeps appearing in the background: regulation.

Climate policy shapes fleet investments. Carbon pricing alters lane economics. Digital rules dictate how documents move. City access schemes change last-mile design. Industrial policy redirects where goods are produced and stored.

Regulation has become the backbone that holds the European logistics system in place. For delivery leaders, it now influences who wins tenders, which platforms remain compatible, and how quickly businesses can respond when markets shift.

Why this is a hot topic in 2026

Several major policy tracks converge:

- Fit for 55 and revised CO₂ standards for heavy-duty vehicles push fleets toward cleaner trucks and vans.

- ETS2 extends carbon pricing to road fuels, lifting the cost of emissions-heavy freight across Europe.

- The eFTI Regulation sets a clear shift to digital freight information through certified platforms.

- Expanding low- and zero-emission zones in cities reward low-emission last-mile models.

- The EU Chips Act and Net Zero Industry Act encourage targeted nearshoring and reindustrialization in strategic sectors such as semiconductors, batteries, and net-zero technologies.

All these measures drive logistics in the same direction: more digital, more transparent, and lower carbon.

To respond, companies need detailed, consistent data about shipments, fleets, documents, and routes. Regulatory pressure is turning that data from a “nice to have” into core infrastructure.

How this pressure shows up in 2026 decisions

In 2026, regulation is firmly embedded in day-to-day choices:

- Fleet managers shape renewal plans around CO₂ targets, city access rules, and the cost signals from ETS2.

- Shippers build ESG reports and board packs that rely on auditable emissions and documentation data.

- Customs and authority interfaces expect structured, machine-readable information rather than scattered PDFs and emails.

- Platforms and software vendors are judged on their ability to support digital documentation, emissions calculations, and regulatory data flows by design.

The common thread is readiness. When rules tighten, organizations that already treat regulatory data as a product can move quickly: adjusting fleets, switching carriers, reshaping networks, and entering new markets with confidence. Those still dealing with scattered spreadsheets and manual documentation feel each new rule as a shock.

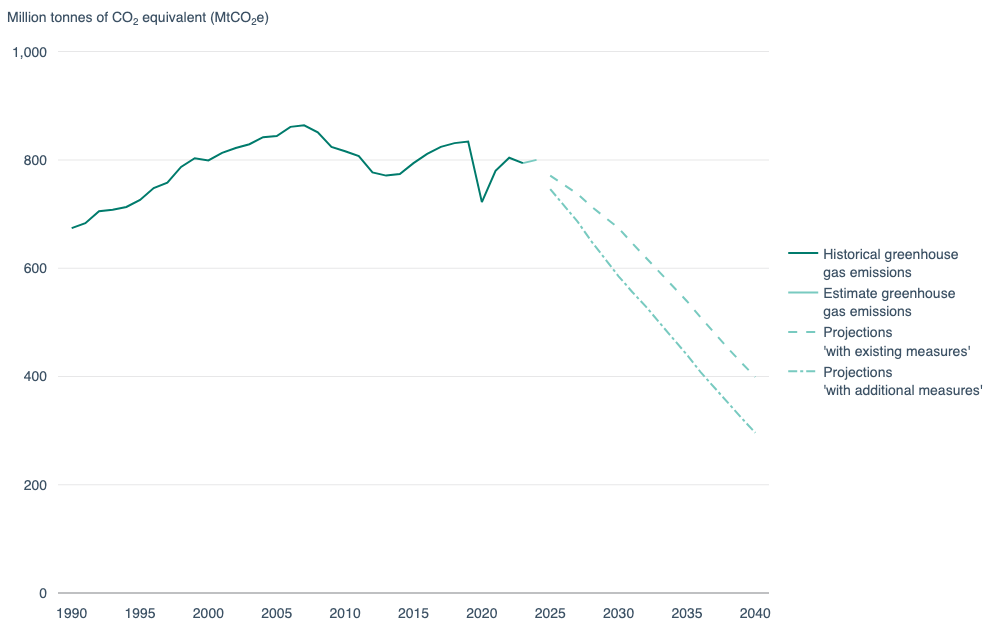

Source: European Environment Agency

Retail and ecommerce leaders: Build regulatory readiness into partner choices

For retail and ecommerce, regulation directly affects which delivery partners are viable and how resilient growth plans really are.

What this means for retail & ecommerce in 2026

- Assess carriers on regulatory alignment alongside price and service.

- Expect shipment-level emissions data and digital documentation as standard features, not custom projects.

- Design networks with an eye on CO₂ trajectories, ETS2 exposure, city access maps, and eFTI timelines.

The goal is not perfection on day one, but a clear direction of travel: a carrier base and tech stack that can grow into the regulatory landscape, rather than fight against it.

Practical moves to make

- Add regulatory questions to RFPs and renewals. Ask carriers for their CO₂ and fleet roadmap, their readiness for ETS2, and their approach to digital documentation and data sharing.

- Connect logistics and ESG teams. Align how emissions targets, reporting requirements, and compliance risks translate into carrier selection, network design, and delivery promises.

- Use delivery data in brand storytelling. When emissions and compliance data are robust, it becomes much easier to talk credibly about “greener delivery” and responsible cross-border operations.

Carriers and LSPs: Turn your compliance roadmap into a sales asset

Carriers and logistics service providers sit at the sharp end of many new rules. Fleet standards, ETS2 costs, city access schemes, documentation requirements, and data expectations all land on their desks.

What this means for carriers & LSPs in 2026

In 2026, shippers will look for partners who can demonstrate:

- Progress toward cleaner fleets that align with European CO₂ trajectories.

- Digital documentation flows that support eFTI and customs processes.

- Reliable, shareable data on transit performance, emissions, and exceptions across key lanes.

The carriers that communicate this clearly gain an advantage whenever contracts are renewed or networks are redesigned.

Practical moves to make

- Develop a clear regulatory narrative. Document how fleet renewal, documentation, and data pipelines evolve over the next 3–5 years, and bring this story into every major customer conversation.

- Invest in both vehicles and information flows. New trucks, vans, or delivery models matter more when they produce structured, machine-readable data that shippers can plug into their own tools.

- Use data to underpin promises. Share lane-level performance, emissions profiles, and documentation accuracy in a way that supports shippers’ ESG reporting and risk management.

Platforms and technology leaders: Treat compliance as part of product-market fit

Delivery management systems, TMS, WMS, customs tools, and related platforms are increasingly judged on their ability to act as compliance multipliers.

What this means for platforms & tech in 2026

By 2026, the most valuable platforms in European logistics will:

- Embed regulatory data structures and workflows directly into their products.

- Support eFTI-compatible data models, shipment-level emissions calculations, and clean integrations with customs and authority systems.

- Give customers a single place to see both operational events and regulatory-relevant information.

For us here at nShift, this trend reinforces the importance of:

- Normalized, carrier-agnostic tracking events.

- Shipment-level emissions and sustainability reporting.

- APIs and data models that align with evolving European digital and customs requirements.

Practical moves to make

- Bake regulation into roadmaps. Treat eFTI support, emissions data, and regulatory integrations as core features that appear in release notes, sales material, and onboarding journeys.

- Expose compliance-ready data through APIs. Make it straightforward for customers to feed shipment, emissions, and document status data into ESG reports, internal dashboards, and authority interfaces.

- Position as simplifiers. When logistics leaders consolidate their tech stacks, they will actively look for platforms that lower the cost and effort of staying aligned with European rules.

Policy makers and regulators: Clarity unlocks investment

Policy makers also sit inside this trend. The way rules are framed and phased determines how easily industry can adapt.

What this means for policy & regulatory teams in 2026

Regulators increasingly depend on:

- Industry data to evaluate the impact of CO₂ standards, ETS2, and eFTI.

- Collaboration with platforms and large operators to understand practical constraints.

- Transparent timelines that give fleets and shippers space to invest and transition.

Clear guidance and stable frameworks create the conditions for meaningful change without constant crisis responses.

Practical moves to encourage

- Publish multi-year roadmaps. Give fleets, platforms, and shippers enough visibility on timing and thresholds to plan capital and technology decisions.

- Engage technology providers early. Work with delivery, TMS, and customs platforms when defining data expectations, so requirements align with real-world capabilities.

- Design proportionate data-sharing models. Ensure authorities receive the visibility they need while respecting privacy, confidentiality, and commercial sensitivities.

The takeaway: Regulation sets the shape of 2026 delivery

Across all ten 2026 delivery trends we have identified, the same pattern appears. Regulation and data define the playing field: which fleets make sense to run, which carriers qualify for tenders, which platforms remain plugged into cross-border flows, and how credible sustainability claims really are.

When organizations treat regulation as a shared backbone for digital, low-carbon, resilient logistics, they gain a clearer path through the next wave of change. Delivery decisions become easier to justify, and compliance creates opportunities instead of surprises.

Get the full picture

This article is part of our research on “The future of delivery: Key trends shaping 2026”, which covers ten interconnected trends across AI, platforms, regulation, resilience, and retail demand.

This article is part of our research on “The future of delivery: Key trends shaping 2026”, which covers ten interconnected trends across AI, platforms, regulation, resilience, and retail demand.

For the complete picture, with detailed data, references, and recommendations for each stakeholder group, download the full report: Future of delivery 2026.

About the author

Thomas Bailey

Thomas plays a key role in shaping how new features and platform improvements deliver real value to customers. With a background spanning product, tech, and go-to-market strategy, he brings a pragmatic view of what innovation looks like in practice and how to make delivery experiences work harder for your business.