In 2026, most of the drama in delivery happens in the last few kilometers.

That “short” distance accounts for roughly 60–70% of total parcel delivery cost, especially in dense European cities where congestion, failed first attempts and access rules eat into margins.

At the same time, customer behavior keeps shifting away from a single home-delivery default:

- Home’s share of European deliveries has fallen from 66% to 54% in a year.

- Delivery to parcel lockers and shops is rising, and 79% of European shoppers return unwanted items via a locker or parcel shop.

Regulators are adding pressure from the other side. Low- and zero-emission zones, curb-space management and CO₂ standards for heavy-duty vehicles all push fleets toward cleaner, smaller, more data-driven operations.

The result: the last mile is no longer a simple “truck plus driver” problem. It’s a design question across networks, cities, carriers and technology. This article explores how last-mile innovation and urban logistics show up as a 2026 delivery trend, and what different players in the chain can do about it.

What last-mile innovation really means in 2026

The hype often focuses on drones and sidewalk robots. The reality is more grounded – and more widespread.

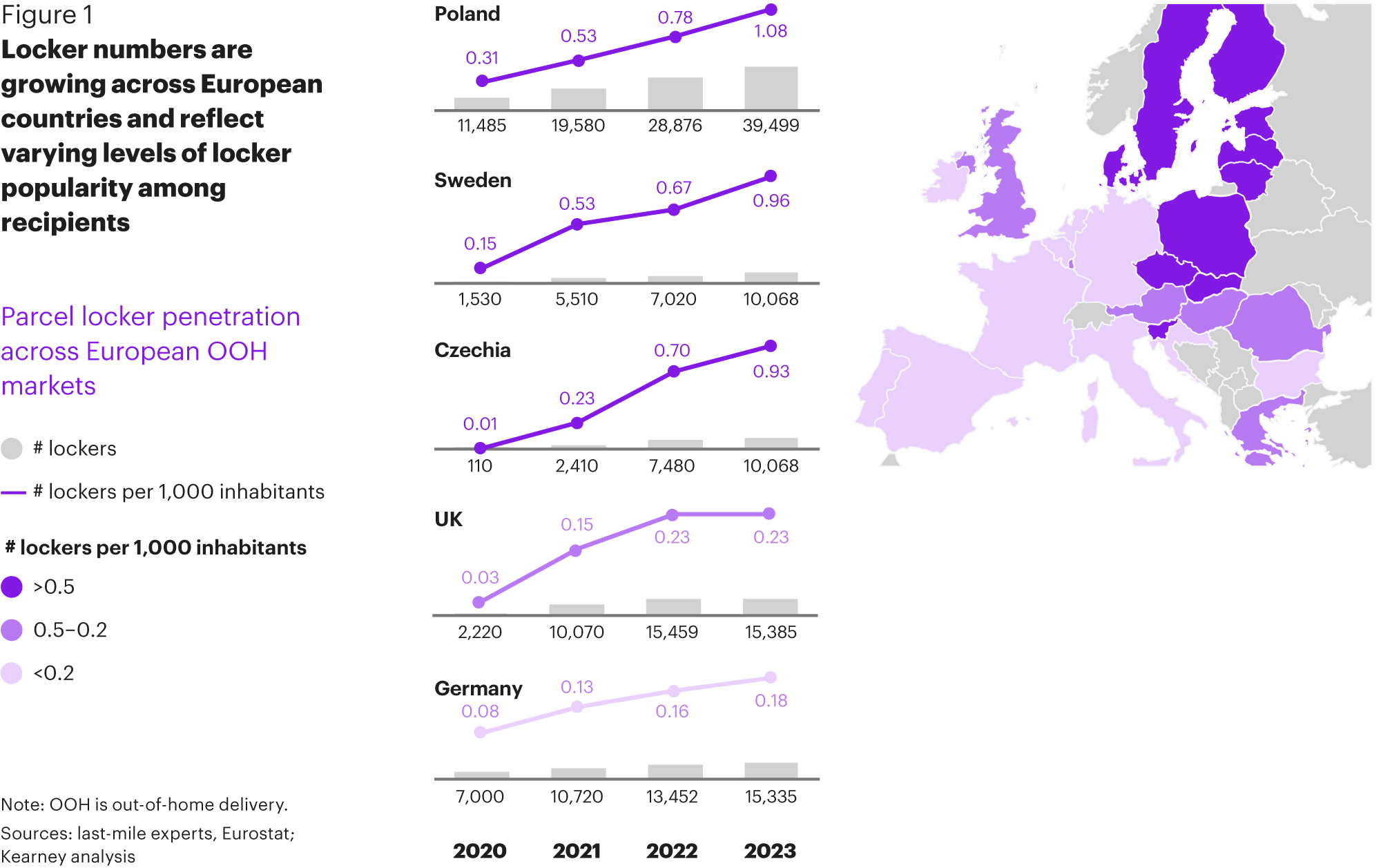

- Dense out-of-home (OOH) and pickup networks

Europe now counts hundreds of thousands of parcel lockers and pickup/drop-off points, with usage growing fast for both deliveries and returns.

For networks, that means:

- Shorter routes with more consolidated stops

- Fewer failed attempts and “sorry we missed you” cards

- More flexible customer journeys (e.g. buy online, pick up near work, return near home)

- Urban consolidation centers and microhubs

To keep vans out of congested cores and comply with LEZ/ZEZ rules, more networks route freight through suburban or edge-of-city hubs, then send smaller EVs or cargo bikes on the final leg.

That changes:

- How linehaul and city routes connect

- Where you position stock and cross-dock capacity

- Which carriers are competitive in a given neighborhood

- New fleets and operating models

Zero-emission vans, e-cargo bikes, and time-windowed access all force a rethink of scheduling, routing and driver productivity. The constraint is often not willingness but infrastructure: charging, secure bike parking, and safe microhub space.

- Data-driven traffic management

Cities and platforms are experimenting with digital curb management, delivery time-slot bookings, and data-sharing schemes to reduce congestion and emissions. This increases the premium on accurate ETA, geofenced events, and standard APIs for exchanging that data.

Put together, “last-mile innovation” in 2026 is less about moonshots and more about network architecture:

Which flows can you move out of home delivery?

How do you combine OOH, EVs, bikes and microhubs into something economically coherent?

And how do you keep the experience simple for the shopper?

Source: Kearney

Retail and ecommerce: Make the city work for your customers, not against them

2026 reality: The last mile is part of the product

For retailers and brands, the city is where promises collide with reality. Shoppers expect:

- Delivery options that match their daily patterns (home, work, lockers, shops)

- Reliable ETAs that respect city constraints

- Clear information on emissions, fees and return routes

When those expectations are not met, they walk. Research shows that 4 in 5 shoppers abandon carts when their preferred delivery or returns options are missing.

At the same time, moving everything by van to the doorstep is becoming harder to justify financially and environmentally.

Moves to make now

Design “city-fit” delivery menus, not one global default

- Offer different mixes of home, locker, pickup, and same-day delivery by city and neighborhood.

- Use A/B tests to understand which combinations maximize conversion and repeat purchase.

Push value into OOH and consolidated options

- Highlight lockers and pickup points as the smart choice: more control, fewer missed deliveries, often greener.

- Pair OOH options with perks such as longer pickup windows or bundled returns.

Plan for rising LEZ/ZEZ constraints

- Map key selling cities against current and planned low-emission zones.

- Prioritize carrier partners with compliant fleets and city-center capabilities.

Use delivery and returns data as product insight

- Track where and when failed attempts occur, which OOH points over- or under-perform, and how delivery choice affects returns.

- Feed those insights back into assortment, sizing, and packaging decisions.

A delivery-experience platform that natively supports OOH, multi-carrier rules, and emissions data makes these moves far easier than re-plumbing each market manually.

Carriers and logistics service providers: Build city networks that still work at 6pm on a rainy Thursday

2026 reality: Cost, regulation and customer promises collide in the last mile

For carriers and LSPs, last-mile economics are under intense pressure:

- City access windows squeeze productive hours

- Electrification requirements change vehicle TCO and routing patterns

- Shippers demand both greener options and stable or lower prices

Those giving rigid “one-size-fits-all” city products will increasingly lose tenders to networks that can flex by neighborhood, time of day and volume pattern.

Moves to make now

Treat OOH and microhubs as core capacity, not side projects

- Use lockers and pickup points to consolidate volume and reduce van kilometers.

- Position microhubs where they materially reduce backtracking and failed attempts, even if that means more, smaller facilities.

Redesign products around clean fleets

- Build distinct service levels that assume EVs, cargo bikes or mixed fleets in LEZ/ZEZ areas.

- Price and market them transparently as compliance-ready, not premium “nice-to-haves”.

Instrument the last mile with events that matter

- Capture precise events for arrival, attempted delivery, locker handover, and customer pickup.

- Expose those via standard APIs so shippers can build accurate ETAs, carbon reporting, and customer notifications.

Simulate before you add cost

- Use routing tools and digital twins to test how changes in OOH share, fleet mix or city rules affect cost per stop and service level before you commit capital.

Multi-carrier platforms like nShift can amplify these investments by making your clean, OOH-rich services easy for shippers to adopt without new point-to-point integrations.

Platforms, IT and data teams: Make urban delivery programmable

2026 reality: Urban logistics needs more than maps

For platform providers, IT, and data teams inside retailers or 3PLs, the last mile is a systems problem:

- You need consistent location models for lockers, PUDOs, stores and hubs

- You need carrier and fleet data normalised enough to support dynamic routing and promises

- You need real-time signals that can flow into checkout, control towers, and customer apps

Without that, urban delivery becomes a patchwork of manual rules and hard-coded exceptions.

Moves to make now

Create a unified “place graph” for the last mile

- Maintain a single, authoritative catalog of OOH points, stores, hubs, and access rules.

- Expose it through APIs so ecommerce, OMS and TMS can all draw from the same map.

Standardize last-mile events and statuses

- Define what “ready for pickup”, “arrived at microhub”, or “locker timeout” mean across carriers.

- Make those events available to AI models, digital twins and customer-facing applications.

Expose configuration, not just tracking

- Let business teams configure OOH eligibility, city-specific delivery menus, and sustainability flags without code changes.

- Use dynamic rules to shift volume between home and OOH or between fleet types as constraints change.

An API-first delivery platform dramatically reduces the amount of bespoke plumbing needed here, especially when it already connects to 1,000+ carriers and large OOH networks.

How last-mile innovation ties into the other 2026 delivery trends

Last-mile and urban logistics do not live in a silo. They sit where several 2026 delivery trends intersect:

- AI and autonomous decision-making: AI models route orders between home, locker and store, and optimize microhub replenishment.

- Predictive analytics and digital twins: city-level twins test how new LEZ rules, OOH share or fleet mixes affect cost and service.

- Platformization and APIs: standardized carrier and OOH APIs make it realistic to orchestrate many city-specific options.

- Electrification and green fleets: EV availability and charging influence where microhubs go and which routes are viable.

- Retail demand evolution: subscription shoppers, social commerce and AI-mediated journeys all raise the stakes for reliable, flexible city delivery.

In other words: the last mile is where many of 2026’s big logistics bets either pay off or fall apart.

Get the full picture

This article is part of our research on “The future of delivery: Key trends shaping 2026”, which covers ten interconnected trends across AI, platforms, regulation, resilience, and retail demand.

This article is part of our research on “The future of delivery: Key trends shaping 2026”, which covers ten interconnected trends across AI, platforms, regulation, resilience, and retail demand.

For the complete picture, with detailed data, references, and recommendations for each stakeholder group, download the full report: Future of delivery 2026.

About the author

Thomas Bailey

Thomas plays a key role in shaping how new features and platform improvements deliver real value to customers. With a background spanning product, tech, and go-to-market strategy, he brings a pragmatic view of what innovation looks like in practice and how to make delivery experiences work harder for your business.