Across European delivery networks, one pattern will keep repeating in 2026: the organizations that move fastest are not the ones with the most custom integrations, they are the ones plugged into platforms.

Instead of dozens of fragile, one-off links between webshops, ERPs, WMSs, TMSs, and carriers, more of the stack now runs through shared, API-first delivery platforms. That shift is being pushed by regulation, by customer expectations, and by simple economics.

This article looks at one of the defining 2026 delivery trends: platformization and API ecosystems. It explains what is actually changing, how it shows up in day-to-day delivery work, and what different players in the chain can do next.

From point-to-point spaghetti to shared delivery infrastructure

For years, logistics connectivity has grown in layers:

- A custom EDI link to a key carrier

- A bespoke integration to a legacy WMS

- A one-off API to support a new market or service

Every project made sense in isolation, but together they left IT teams with a brittle web that is expensive to maintain and slows down every change. Platformization is the response to that complexity.

Multi-carrier platforms and delivery management systems now sit in the middle as shared infrastructure. They provide:

- One place to onboard and manage carriers

- Standardized APIs for booking, labels, tracking, and delivery options

- Consistent event models so “in transit”, “exception”, and “delivered” mean the same thing everywhere

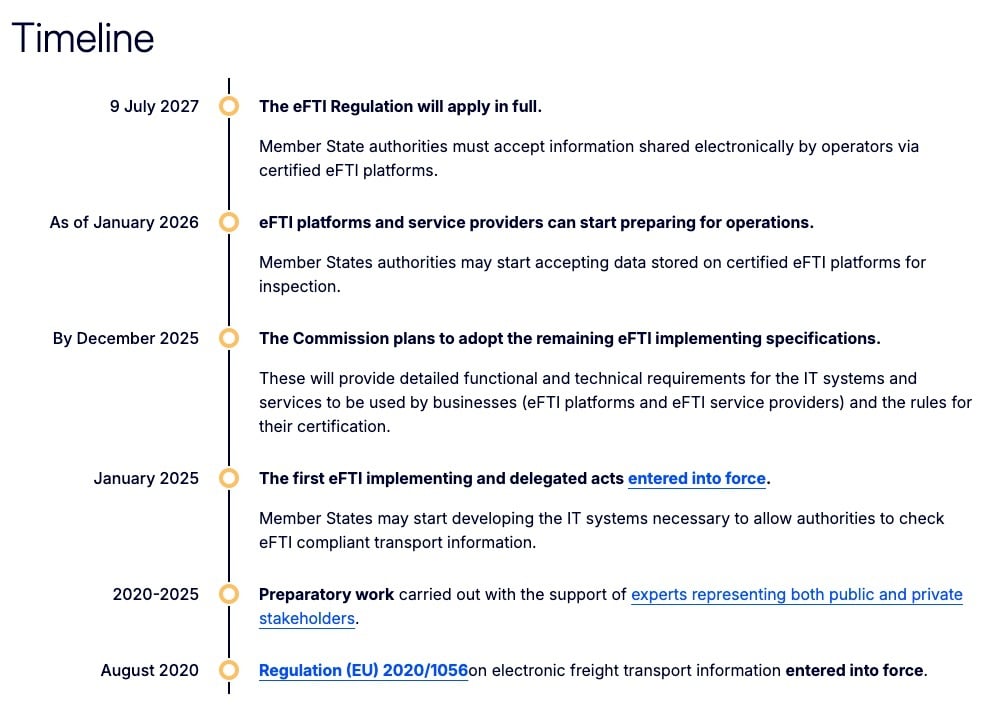

Regulation and standards amplify this trend. eFTI pushes freight documentation into certified digital platforms. Industry bodies such as DCSA publish open API standards for track and trace and electronic bills of lading. Market analysts estimate the global logistics API market in the low billions of dollars and growing at just over 20% per year, which shows how quickly investment is shifting toward this model.

In 2026, the attractive partners in European logistics are not simply the cheapest; they are the easiest to plug into.

What platformization actually looks like in delivery

On the surface, platformization shows up as smoother projects and faster launches. Underneath, it involves a few concrete changes.

- One integration, many carriers

Retailers, warehouses, and marketplaces connect once to a delivery platform. The platform handles the variety beneath that layer: carrier labels, routing rules, service codes, and status events. Adding a new carrier or service becomes a configuration task instead of a six-month IT project.

- Standard building blocks for delivery flows

Booking shipments, generating labels, returning tracking events, offering lockers and PUDO locations, and supporting returns all use the same APIs and data structures. That consistency makes it far easier to build experiences around delivery, from checkout to post-purchase journeys. - Ecosystems instead of isolated tools

Address validation, emissions calculations, fraud checks, and even post-purchase media can plug into the same backbone. That reduces duplication and lets teams swap components without re-wiring every system. - Compliance built into the pipes

Because regulation increasingly expects structured, auditable data, platforms become an obvious place to embed rules for documentation, event logging, and consent. That is much simpler than trying to retrofit each individual integration.

For most organizations, rather than ripping everything out, this will be about choosing which parts of the delivery stack should be custom and which should be standardized and shared.

Why API ecosystems matter so much in 2026

Three pressures make platformization more than a nice idea in 2026.

Cross-border and multi-market growth

European retailers and brands increasingly sell across borders. Each new market comes with new carriers, new service types, and new customer expectations. Without a platform, every market expansion becomes a tangle of bespoke work. With a platform, most of that is pre-integrated.

Regulation and data requirements

eFTI, emissions reporting, and customs digitalization all rely on clean, machine-readable data moving between many parties. Shared platforms with standard APIs are simply better suited to that job than dozens of one-off connections.

AI, control towers, and twins upstream

The predictive capabilities we're also talking about need normalized events and stable APIs to function. AI agents, control towers, and digital twins are only as strong as the delivery data they receive. Platforms are where that data is collected, cleaned, and exposed.

In practice, platformization is what turns delivery data from “integration by-product” into an asset that planners, service teams, and AI systems can actually use.

Retailers and brands: Treat delivery connectivity as strategic infrastructure

For retailers and brands, platformization is no longer just an IT topic: it directly affects conversion, NPS, and the cost of growth.

What this trend means for you

The retailers that get ahead in 2026 will:

- Offer consistent delivery and returns options across markets without rebuilding integrations every time

- Test new carriers, lockers, and out-of-home options quickly, then scale what works

- Feed clean shipment, option, and emissions data into AI agents, analytics, and marketing tools

Those that stay on custom, point-to-point integrations will feel the drag in every new initiative. Adding a sustainable option, supporting a new marketplace, or changing post-purchase communication will always take longer and cost more than it should.

Moves to make now

- Map your current “delivery integration footprint”. Identify how many separate carrier and system integrations you maintain and which ones cause the most friction.

- Decide where a multi-carrier delivery platform should sit in your architecture. Typically it becomes the hub between ecommerce, OMS, WMS, ERP, and the carrier network.

- Start shifting new projects onto that hub first. For example, launch lockers or PUDO in one market through the platform, then roll out to others.

An API-first delivery platform is built for this role. It already exposes carrier connectivity, options, tracking events, and emissions data through standard APIs, so retail teams can focus on experiences, not plumbing.

Carriers and logistics service providers: Being “easy to plug into” wins tenders

For carriers and LSPs, platformization changes how shippers evaluate partners.

Price and network still matter. But increasingly, shippers and 3PL customers ask:

- How quickly can we integrate you into our stack or platform?

- How reliable and granular are your events?

- How well do you support eFTI, emissions reporting, and cross-border documentation?

Carrier propositions that answer those questions convincingly will stand out in 2026.

Moves to make now

- Invest in robust, well-documented APIs for booking, labels, tracking, and returns, and make sure they map cleanly to major delivery platforms.

- Treat event quality as a product. Time-stamped, standardized events for pickup, handover, delays, and delivery are what feed shippers’ control towers, twins, and customer apps.

- Align commercial strategy with technical reality. Make it explicit in tenders how your APIs, documentation, and platform presence reduce integration cost and time for shippers.

Being connected through a platform like nShift amplifies these strengths. Once a carrier is integrated there, multiple shippers can access that connectivity without repeating the work.

Platforms and tech providers: Compete on ecosystem, not just features

If you build ecommerce platforms, ERPs, WMSs, TMSs, or delivery management systems, platformization is both an opportunity and a test.

Customers no longer want a closed suite that insists on being the center of everything. They want systems that:

- Plug into multi-carrier platforms without custom engineering

- Expose their own APIs in a predictable way

- Support open standards for events and documentation

Moves to make now

- Define and publish clear schemas for shipments, orders, and events. Make those schemas compatible with major delivery platforms and industry standards.

- Build out “ecosystem ready” APIs, then back them with documentation, sandboxes, and support.

- Ship reference patterns instead of raw features, for example: “Connect your webshop, WMS, and nShift to offer lockers and calculate emissions in under X days.”

The vendors that position themselves as part of a broader ecosystem, rather than trying to own every integration, will be more credible partners for customers who are already committed to platformization.

IT, data, and analytics teams: Build an API backbone that can survive the next decade

For IT and data leaders, this trend is about simplifying the stack while increasing flexibility.

What to prioritize

- Consolidate delivery connectivity into one or a small number of hubs. Reduce the number of unique carrier and system integrations you maintain.

- Define a “delivery data contract”: what a shipment is, which events exist, which fields are mandatory, and how time, location, and identifiers are represented. Apply it consistently.

- Plan migration in waves. New projects and markets move to the platform first. Legacy connections follow as they reach end of life or become too expensive to maintain.

This is also where future AI and analytics work will run. The cleaner and more standardized your API backbone is, the easier it becomes to plug predictive models, decision engines, and digital twins into delivery data.

How platformization underpins the rest of the 2026 delivery trends

Platformization does not sit in a silo. It quietly supports the rest of the 2026 delivery landscape:

- AI and autonomous decision-making need normalized events and stable APIs to act on.

- Predictive analytics, control towers, and digital twins depend on consistent data across many carriers and systems.

- Delivery choice and last-mile innovation require a way to orchestrate home delivery, lockers, PUDO, and green options without custom wiring each time.

- Regulatory backbone and data: far easier to manage when documentation, emissions, and access rules are built into shared pipelines rather than scattered across many links.

If delivery is where brands keep or break their promises, platformization is increasingly the fabric those promises run on.

Get the full picture

This article is part of our research on “The future of delivery: Key trends shaping 2026”, which covers ten interconnected trends across AI, platforms, regulation, resilience, and retail demand.

This article is part of our research on “The future of delivery: Key trends shaping 2026”, which covers ten interconnected trends across AI, platforms, regulation, resilience, and retail demand.

For the complete picture, with detailed data, references, and recommendations for each stakeholder group, download the full report: Future of delivery 2026.

About the author

Thomas Bailey

Thomas plays a key role in shaping how new features and platform improvements deliver real value to customers. With a background spanning product, tech, and go-to-market strategy, he brings a pragmatic view of what innovation looks like in practice and how to make delivery experiences work harder for your business.