In 2026, the front end of retail and the back end of delivery are no longer separate worlds.

AI assistants compare products and delivery promises in seconds. Retail media networks monetize tracking pages. Shoppers switch between home, store, lockers, and cross-border offers without thinking about channels at all.

This article looks at one of the most important 2026 delivery trends in our research: the evolution of retail demand itself. It’s the context that all the 2026 hot topics we have identified sit inside.

AI-mediated shopping rewrites “where demand comes from”

Across Europe, more of the decision-making happens through software:

- Shoppers use AI assistants to summarize reviews, compare offers, and reorder everyday items.

- Retailers and marketplaces use AI to personalize content, offers, and delivery options.

- Service bots handle routine delivery and returns questions, while people step in for complex or emotional cases.

In practical terms, this means:

- Clean, structured data wins placement. Product attributes, prices, delivery options, and returns rules need to be machine-readable if you want to show up in AI-mediated journeys.

- Delivery becomes part of the recommendation. Assistants won’t just ask “Which shoe?” but “Which shoe, with a trusted delivery promise, under this total cost, by Friday?”

If your delivery and returns data is vague, inconsistent, or siloed, AI agents will quietly route demand elsewhere.

Omnichannel expectations raise the bar for delivery and returns

Customers now expect to move fluidly between channels:

- Check store availability online before they visit.

- Switch between home delivery, lockers, and store pickup depending on the day.

- Return in store, by mail, or via PUDO – whichever feels easiest at the time.

That raises expectations in three areas:

- Inventory accuracy

Shoppers assume that “available in store” is true in real time. Gaps between online promises and store reality translate straight into lost trust. - Fulfillment routing

Customers don’t care which DC or store ships their order. They care that the option they chose at checkout is respected and that changes are communicated. - Reverse logistics

Returns flows need the same clarity as outbound: options, cut-offs, and refund timelines that are easy to understand and reliably met.

In 2026, delivery promise, delivery choice, and returns simplicity are all part of the product in the customer’s mind.

Cross-border ecommerce becomes a default behavior

For many European shoppers, cross-border is normal, not exceptional:

- They cross borders for better prices, specific brands, or subscription offers.

- They expect local payment methods, clear duties and taxes, and simple returns.

- They compare domestic and cross-border options side by side in AI assistants and marketplaces.

That puts pressure on logistics in three ways:

- Multi-carrier, multi-lane networks have to support a wider set of origin–destination pairs.

- Customs and compliance data must be accurate and ready for automation, or orders will stall at the border.

- Cross-border returns need to feel as predictable as domestic ones, even if the underlying flows are more complex.

For retailers and logistics providers, the question is less “Should we go cross-border?” and more “Can our delivery and returns keep up with how people already shop?”

What this means for key players

Retailers and brands: Treat delivery data as part of the commercial proposition

For ecommerce, marketing, and supply chain leaders, the evolution of demand in 2026 means:

- Product and logistics data must be AI-ready.

That includes consistent attributes, clear delivery terms, structured returns policies, and reliable availability signals across channels. - Delivery and returns are levers, not footnotes.

You can tune options, promise dates, and messaging by country, segment, and device, then link those choices to conversion, AOV, and repeat-purchase metrics. - Cross-border journeys need end-to-end clarity.

Shoppers want transparent landed costs, local payment options, and trusted returns paths. Anything that feels opaque introduces hesitation.

Practical next steps:

Audit your product, delivery, and returns data from the point of view of an AI assistant and a human shopper. Where is it incomplete, inconsistent, or buried in PDFs?

Build a small set of experiment “kits”: combinations of delivery options, promises, and messages that you can A/B test in key markets.

Connect your delivery and returns KPIs (on-time rate, failed deliveries, refund cycle time) directly to your commercial dashboards.

Marketplaces and ecommerce platforms: Orchestrate choice without overwhelming buyers

For marketplaces and ecommerce platforms, this trend is about mediation at scale:

- Seller tools must make rich delivery and returns options easy to configure, while keeping the front end simple.

- Market-specific logic is essential: which options to surface in which country, for which categories, under which cut-off times.

- AI-ready feeds of availability, options, and promises are part of your value to both sellers and assistants.

Practical next steps:

- Standardize how you capture and expose delivery and returns options in your seller tools and APIs.

- Model market-specific rules for lockers, PUDO, store pickup, and green options so that buyers only see relevant choices.

- Make sure tracking events and returns statuses can flow into retail media, CRM, and AI assistants in structured formats.

Payments and fintech providers: Connect payments, promises, and delivery data

For payments players:

- Tokenized, agent-friendly payment flows increasingly sit next to delivery and returns decisions.

- Retailers and platforms need simple ways to let AI agents evaluate total cost and delivery options before triggering a transaction.

- Reliable order and shipment data are needed for post-purchase experiences, disputes, and subscriptions.

Practical next steps:

- Design payment flows that can surface delivery options and prices in real time, including taxes and fees, before committing the transaction.

- Provide clear APIs that allow retailers and logistics platforms to share status updates and refunds back into your ecosystem.

- Work with retail and logistics partners on shared identifiers so that payment, order, and delivery data line up.

Logistics and delivery platforms: Become the structured source of truth

For logistics and delivery platforms, this trend is an opportunity to sit closer to demand creation:

- APIs for pricing, options, promise dates, emissions, and tracking need to be clear enough for both humans and AI agents to consume.

- Branded tracking and post-purchase journeys become surfaces for reassurance, upsell, and retail media.

- Emissions and service performance data feed directly into procurement, sustainability reporting, and customer choice.

Practical next steps:

- Expose delivery options, ETAs, and emissions per service and per shipment in structured, documented APIs.

- Support configuration of “guardrails” that assistants can use (for example, fastest sustainable option under a given price).

- Provide event streams that service bots and retail media tools can subscribe to, so that tracking pages and notifications stay in sync with reality.

How this ties into other 2026 delivery trends

The evolution of retail and customer demand is tightly linked to the other 2026 delivery trends in the report:

- It depends on AI and autonomous decision-making to power assistants, recommendations, and service bots.

- It relies on predictive analytics and control towers to make the delivery promises shown at checkout realistic in volatile networks.

- It needs platformization and APIs so that product, delivery, and emissions data can flow between retailers, carriers, and AI agents.

- It amplifies delivery choice and last-mile innovation, because customers increasingly select brands based on the options they see at the moment of purchase.

- It is shaped by regulatory backbone and data requirements, which determine what must be tracked, reported, and shared.

Viewed this way, it’s less a standalone topic and more the “demand surface” where all the other 2026 delivery trends we have identified show up for customers.

Where nShift fits in this picture

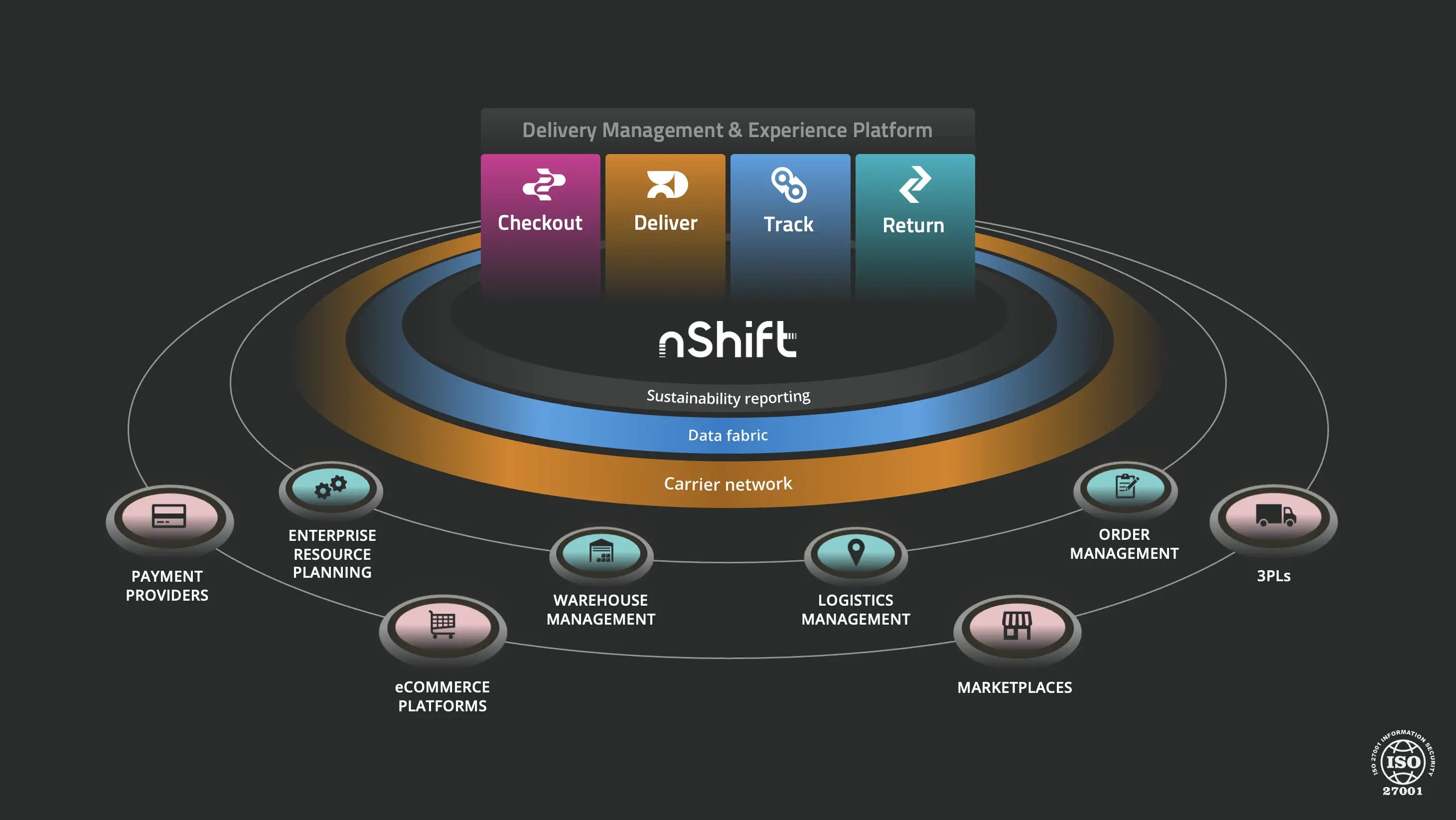

Our Delivery & Experience Management platform is designed for exactly this junction between demand and delivery.

- It connects retailers, brands, and marketplaces to over 1,000 carriers, standardizing delivery options, rules, and tracking events across markets.

- It exposes those options and events through APIs that ecommerce platforms, AI assistants, and service bots can consume.

- It powers branded tracking and post-purchase journeys that combine reassurance for customers with structured data for service teams and retail media.

That gives stakeholders a way to turn the evolution of demand into practical delivery choices, without rebuilding every integration from scratch.

If “demand” now depends on how confident customers feel about delivery and returns, then delivery data, options, and promises are part of your growth strategy.

Get the full picture

This article is part of our research on “The future of delivery: Key trends shaping 2026”, which covers ten interconnected trends across AI, platforms, regulation, resilience, and retail demand.

This article is part of our research on “The future of delivery: Key trends shaping 2026”, which covers ten interconnected trends across AI, platforms, regulation, resilience, and retail demand.

For the complete picture, with detailed data, references, and recommendations for each stakeholder group, download the full report: Future of delivery 2026.

About the author

Thomas Bailey

Thomas plays a key role in shaping how new features and platform improvements deliver real value to customers. With a background spanning product, tech, and go-to-market strategy, he brings a pragmatic view of what innovation looks like in practice and how to make delivery experiences work harder for your business.