2021 was a turbulent year for most, including retailers. Amidst a struggle for HGV drivers, shipping container problems in Asia, the impact of Brexit, and worker shortages, there’s been a lot to balance. Now that we’re at the end of the year, it seems like the time to look back and reflect on how these issues impacted retail and ecommerce over the last twelve months. Whether your business is a retailer, ecommerce shipping software, or ecommerce shipping carrier, it’s likely you’ve been affected.

Supply chain problems seemed to dominate the concerns of retailers, as many had trouble receiving stock on time and getting them to their customers. HGV drivers were down by a third and seasonal workers are hard to find, with 1 million unfilled positions in the UK alone. Amidst the chaos, retailers and suppliers are struggling to keep up, as one retailer commented that ‘it feels as though the supply chain is past its capacity’. Retailers have had to change their strategies to find shipping solutions.

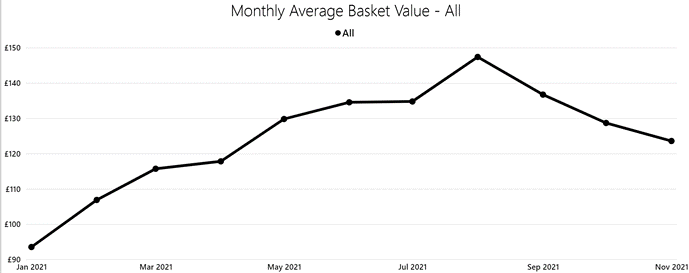

The most noteworthy trends within the ecommerce industry this year can be found in the changes in conversion rate, as well as the amount of money people are willing to spend in one purchase. Conversion rates have dropped by 25% - one reason for which could be customers not finding what they’re searching for as a result of supply chain issues. Average basket value has also hugely increased, although overall revenue was down. This could be due to inflation, and rarity of stock, meaning that people are spending more to get the items they want.

Monthly Average Basket Value for 2021

(IMRG’s Digital Dashboard)

Data from IMRG suggests that homeware saw the largest acceleration (+55%) in sales since the pandemic, as people had more time around the home, whilst ecommerce business has accelerated rapidly overall, due to the need for online shopping. Gift and clothing categories saw the least growth during this time, but on the plus side, there’s been an increase in the average basket volume. ABV was up by 60% in June and July this year, meaning shoppers were spending more in one shop.

Aside from the volume of sales itself, another significant trend is the weight that’s been taken off discounts as a means to drive sales. This is likely because stock shortages mean buyers might be more willing to pay full price for an item when they find what they need.

Over the course of Black Friday 2021, we saw changes in customer behavior since last year too. Due to the release in pressure on discounting, and the return of customers to the high street, Black Friday was down 14% overall. This was mainly due to stores being open in person again, and a battle for traffic across retail sights.

To conclude, we can see that it was difficult for the industry to grow over 2021, due to such high performance in 2020. However, regardless of this past year’s growth, it’s important to look to the future in order to make some predictions about what could be expected in 2022. With a new COVID-19 variant causing chaos, there may be reason to believe we could be heading for another lockdown, therefore perhaps creating the possibility of growth for the ecommerce industry once again, if we move back to online shopping.