The ecommerce market has been put under extreme pressure recently, with geo-political issues such as the Russo-Ukraine crisis, and the rapidly increasing price of living. So how have UK retailers coped with this extra strain, and what does it mean for the economic quarter ahead?

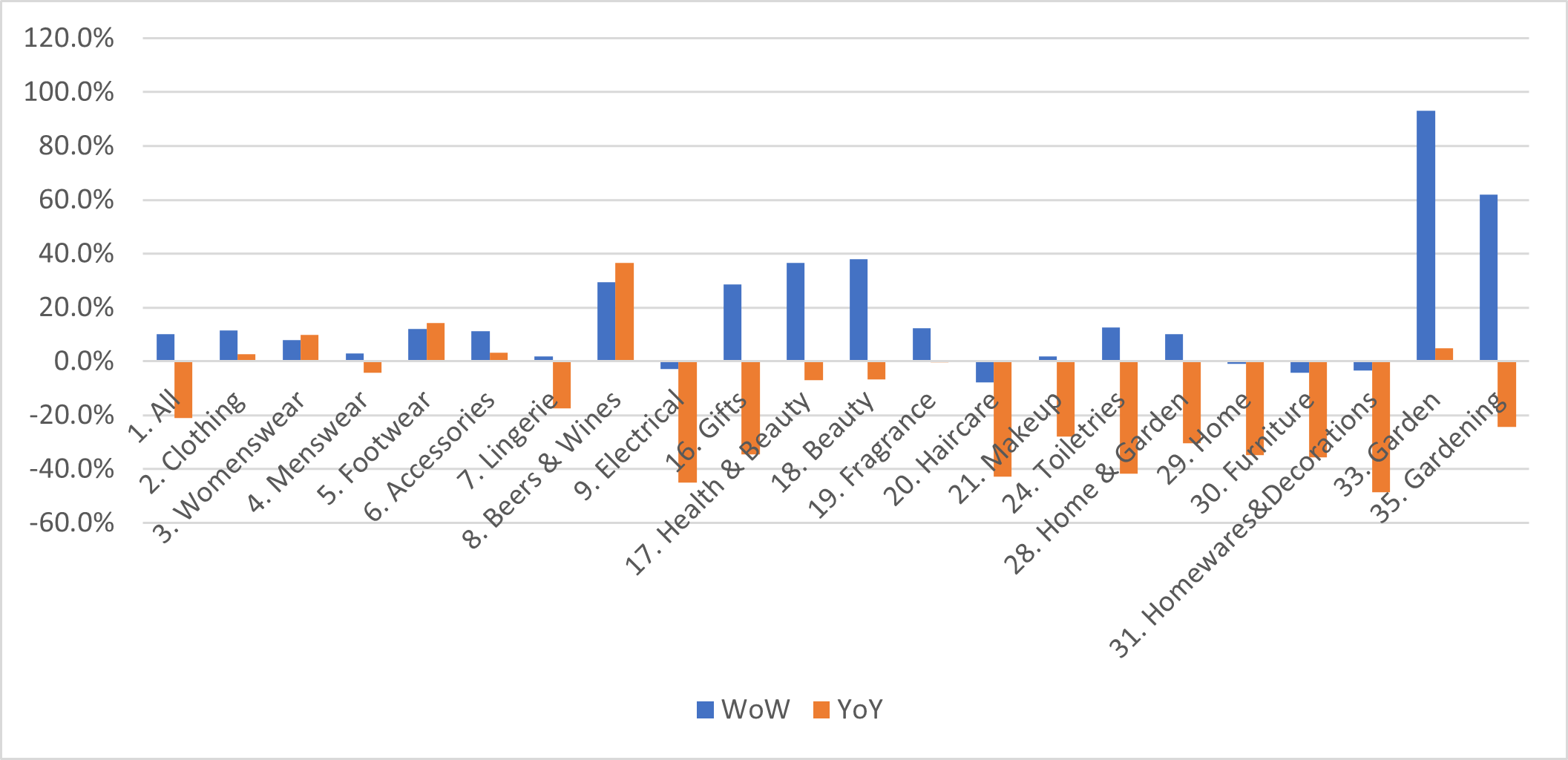

Looking at a category analysis of the week commencing 20th March, we can see which areas prevailed with growth, and where the pinch points were.

According to IMRG’s digital dashboard, the market was down -21% year-on-year overall, but the data is more complex than this. Clothing generally seems to be performing actually quite well, because as a whole it’s up +2.6%, with womenswear up +9.8% year-on-year, and footwear up +14.2%. However, menswear and lingerie are in the negative, bringing the overall figure down. Beers wine and spirits is actually up 36.5% against last year too.

However, it seems to be the majority of other categories which are bringing this market growth down. Electrical is down -44.9% YoY, and gifts is at -34.5%. Home and garden experiencing a similar downturn at -30.3%.

When looking at the week-on-week measure, clothing continues to perform particularly well, alongside health and beauty, gifts, and womenswear. Some of this weekly growth could have been attributed to Mother’s Day gift purchasing, as fragrance and makeup saw uplift, with gifts seeing +28.5% growth week-on-week.

Category Growth Week on Week (WoW) and Year on Year (YoY)

Source: IMRG’s digital dashboard

Interestingly, the data depicts a mixed bag when it comes to category performance, and would likely show even more disparity if broken down on the basis of each individual retailer. This is because retailers are perhaps reporting varied results week by week, as consumers are taking more persuasion to part with their money. With the current squeeze on spend, shoppers may be browsing for a bit longer before committing to making a purchase. Therefore, this is making the market results appear tumultuous week by week. Retailers could be employing discounting methods or other incentives to keep customers purchasing from their site over others, as they deliberate over how best to spend their money.

Therefore, whilst many online retailers have been concerned about a downturn in the market, it seems as though the data could be showing how they are staying afloat overall. These concerns and dips in the data may be felt on an individual basis, as it appears as though retailers are somewhat successfully problem solving within their strategy, in order to keep results positive at such tough times. In order to continue to succeed in the months ahead, retailers will need to think on their feet so they can keep conversion high, as customers become less willing to immediately part with their money.