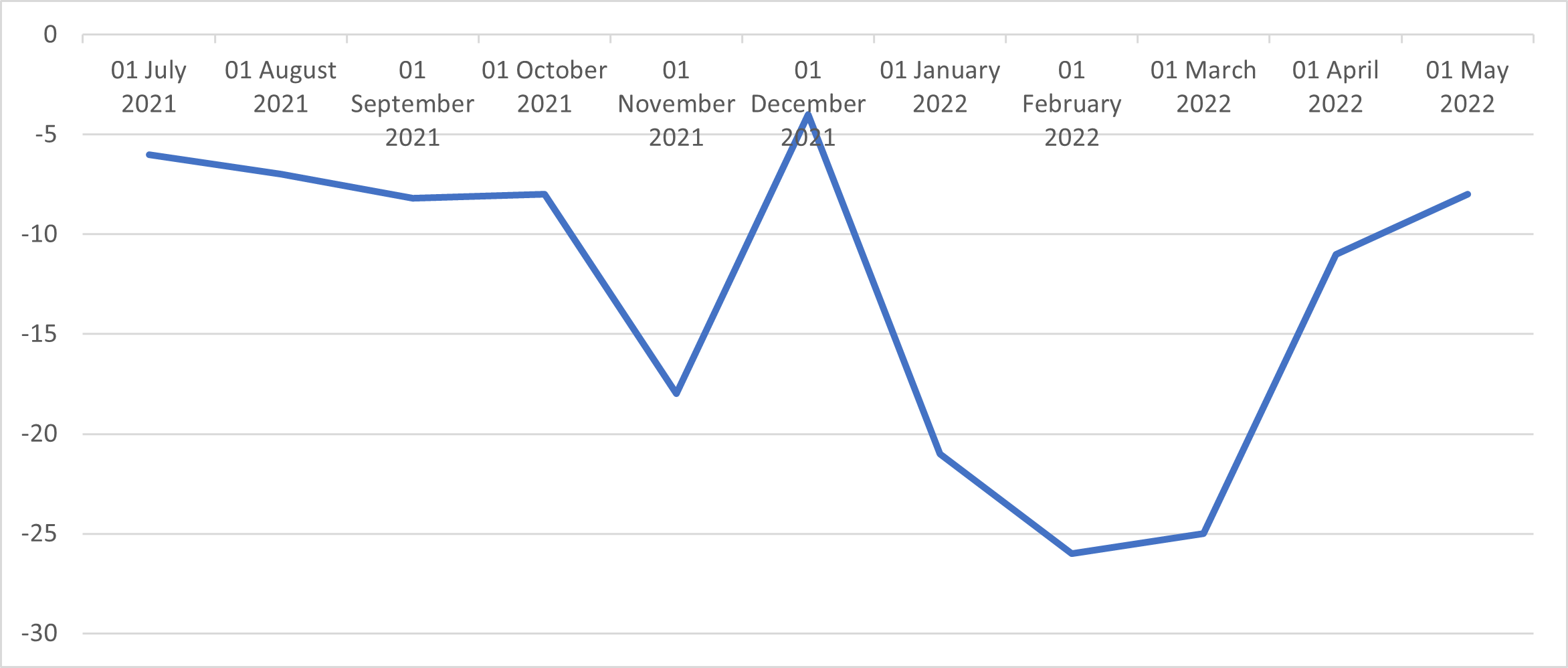

After concerningly underwhelming results for the market in April, many retailers were left wondering what the next few weeks had in store for them. IMRG has been tracking the online retail market for years, and according to their digital dashboard, we can now tell what the last month looked like in summary. Now that May results are out, we can see that the market is showing better Year-on-Year growth compared to April, at -8.7%, up from -11% the month before. However, using the Month-on-Month measure, the index showed a -0.6% decline.

Source: IMRG’s Digital Dashboard

Over the four weeks of May, performance saw a lot of variation, as week 1 showed the worst growth (-10.9% YoY) and week 3 came in highest (-0.3%) and very close to neutral. Were it to have broken into positive territory, it would’ve been the first time since Black Friday of 2021…

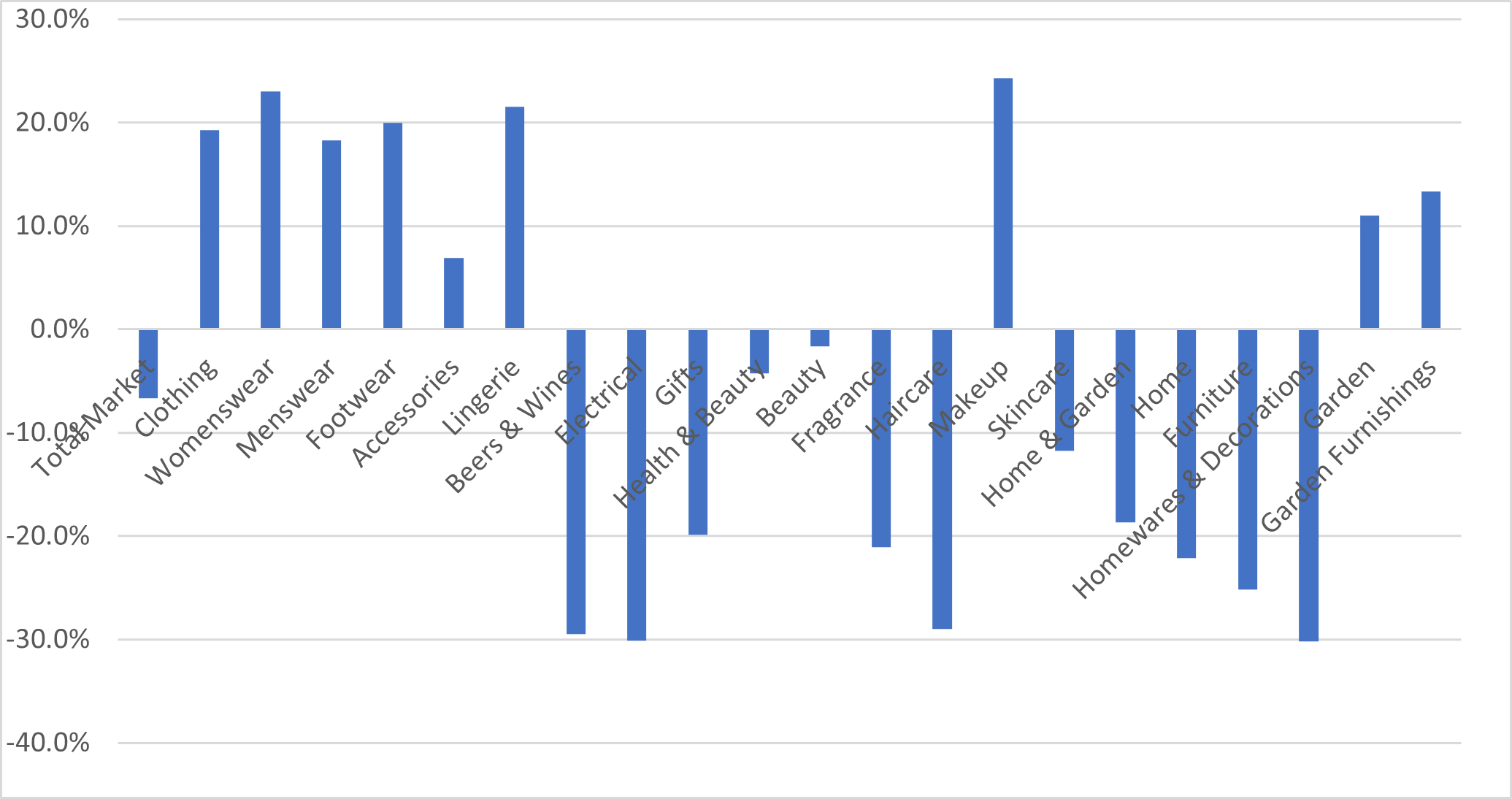

Breaking down the data, it’s interesting to see performance on a category level as well. Whilst the market is down -8%, it’s not all bad news. For example, clothing has reported its best growth in a year (since June 2021), at +14% YoY. Out of the largest 10 clothing retailers in IMRG’s panel, 6 of them reported a double digit positive growth, and only two recorded YoY declines.

Source: IMRG’s Digital Dashboard

At the start of the year, IMRG made a prediction as to what 2022 would look like, in which they forecast 3 scenarios: ‘good’, ‘average’, and ‘bad’. The current performance of the market sits at -19.4% Year-to-Date (January, until May), which aligns strongly with the ‘bad’ prediction of -19.1% which was predicted back at Christmas. It’s no wonder that the market has been showing such ‘bad’ growth and recovery from the pandemic, due to the cost of living crisis, was in Ukraine, ongoing supply chain issues, and skyrocketing energy bills. Retailers, merchants, and suppliers alike are all hoping to see some neutral growth in the coming months, to signal an uplifting ‘new normal’.