How They’ll Spend It, produced by Retail Week in partnership with nShift, explores UK shoppers' sentiments for Christmas 2023 and beyond.

Though purse strings are tighter this year, many opportunities exist across multiple categories. Investing in an outstanding e-commerce delivery experience can help retailers stand out and surprise and delight customers – again and again.

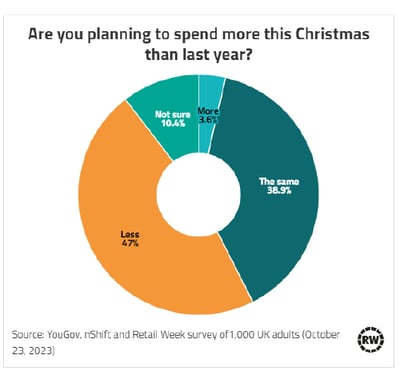

The 1000 UK consumers polled for our survey predict Christmas 2023 will be thriftier than previous years. 47% of respondents say they plan to spend less than last year, and only 3.6% agree they expect to spend more.

The 1000 UK consumers polled for our survey predict Christmas 2023 will be thriftier than previous years. 47% of respondents say they plan to spend less than last year, and only 3.6% agree they expect to spend more.

Almost half the respondents indicated Christmas shopping would be an online-only affair. The ability to easily compare prices online helps customers save money.

What are UK shoppers buying this Christmas?

Food and alcohol, including hampers, is the top category for spending this year, selected by 41% of respondents. Books and stationery were selected by 29%, with toys highlighted by 26%.

Surprisingly, electricals and gadgets – firm Christmas favorites in previous years – were chosen by just 13% of shoppers.

What are the opportunities for retailers going into 2024?

Shoppers were asked about their spending priorities over the next six months – taking us well into 2024.

When asked where they planned to cut spending, the largest proportion - 28% - highlighted entertainment and eating out. That could translate into new opportunities for retailers to surprise and delight customers spending more time at home.

Discretionary spending is under pressure in other areas.

Some 16% of respondents said they plan to cut spending on fashion, while 14% highlighted reducing outlay on big-ticket items like furniture.

A closer analysis of fashion retail suggests high-end and value-oriented retailers are growing while the midrange is being squeezed. That suggests consumers are “saving and splurging” as they make their spending work harder.

That, in turn, presents opportunities for retailers in these areas to reach out to new customers with discounts, vouchers, and other incentives.

How can retailers build customer loyalty in 2024?

Incentives like vouchers only work if customers decide to buy again and again. And for that to happen, every part of the customer experience, from the homepage to receiving the deliveries – and perhaps returning them – has to run smoothly.

Retailers have made big investments in the customer experience up to the checkout page. But what happens after that is often outsourced to carriers.

That’s why deliveries matter. Deliveries are where the brand and the customer meet for the first time. If the delivery fails, the retailer also fails.

On the other hand, an outstanding delivery experience helps retailers stand out and encourages repeat purchases.

58% of consumers agreed with the statement, "If something is delivered efficiently, I would be more likely to buy from the retailer again".

However, 48% of respondents said if they had a bad delivery experience, they’d be reluctant to recommend it to friends and family. And 42% said they’d abandoned a retailer for not offering the most convenient delivery options.

About the author